Managing business finances can be a daunting task. From keeping track of multiple accounts to ensuring timely bill payments, it’s easy to feel overwhelmed. For businesses in the UAE, Etisalat Business Quick Pay offers a revolutionary solution to these challenges. With its streamlined platform, you can handle your payments efficiently, securely, and without unnecessary delays.

In this blog, we’ll take a closer look at what Etisalat Business Quick Pay is, its features and benefits, and why it’s a must-have tool for UAE businesses. Whether you’re a small enterprise or a large corporation, this service is designed to simplify your financial management.

What Is Etisalat Business Quick Pay?

Etisalat Business Quick Pay is a cutting-edge online payment platform tailored for businesses in the UAE. It allows companies to settle their bills effortlessly through a secure and user-friendly interface. Whether it’s managing internet subscriptions, utility bills, or corporate accounts, this service is designed to streamline the entire process.

Unlike traditional payment systems, Etisalat Business Quick Pay eliminates the need for physical paperwork or long waiting times. You don’t even need to register or log in just access the platform, make your payment, and receive instant confirmation.

This service empowers businesses to focus on growth and productivity instead of getting bogged down by administrative tasks. With the digital shift in corporate operations, Etisalat Business Quick Pay aligns perfectly with the needs of modern businesses.

What Are the Key Features of Etisalat Business Quick Pay?

Etisalat Business Quick Pay is packed with features that cater to the dynamic needs of businesses:

1. Quick and Hassle-Free Payment Process: One of the standout features of Etisalat Business Quick Pay is its simplicity. The platform allows businesses to pay their bills in just a few steps. There’s no need for lengthy sign-up processes or waiting for confirmations—it’s all instantaneous.

2. Secure Online Platform: Security is paramount in business transactions, and Etisalat ensures that every payment made through its platform is safeguarded by advanced encryption technology. This means your financial data and sensitive information remain protected at all times.

3. Multi-Account Payment Support: Managing multiple accounts can be challenging, but Etisalat Business Quick Pay makes it a breeze. Whether you have one account or several, the platform supports multi-account payments, ensuring you can settle all bills from a single dashboard.

4. 24/7 Accessibility: Etisalat Business Quick Pay is available round the clock, enabling businesses to make payments anytime, anywhere. This flexibility is particularly beneficial for enterprises with tight schedules or operations spanning different time zones.

5. Customizable Payment Options: The platform offers customizable payment features, including options to pay specific amounts, choose billing cycles, and set reminders for future payments.

How to Use Etisalat Business Quick Pay?

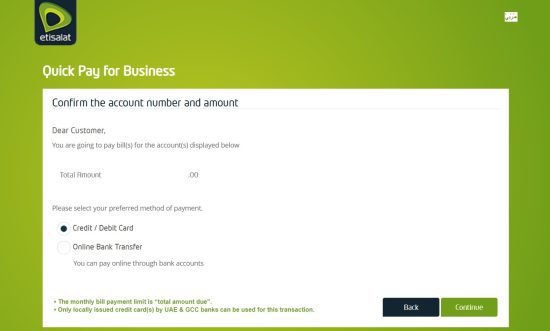

Image – Source

Here’s how you can make the most of Etisalat Business Quick Pay in a few simple steps:

Step 1: Access the Quick Pay Portal

Visit the official Etisalat Business Quick Pay portal.

Step 2: Enter Your Business Account Details

Input your registered account number or the required credentials to access your bill information.

Step 3: Select the Bills to Be Paid

The platform will display all outstanding invoices linked to your account. Choose the bills you want to pay.

Step 4: Confirm Payment Details

Review the payment amount and ensure all details are correct.

Step 5: Make the Payment

Use your preferred payment method (credit/debit card or other supported options) to complete the transaction.

Step 6: Receive Confirmation

Once the payment is successful, you’ll receive a confirmation message via email or SMS.

What Are the Benefits of Using Etisalat Business Quick Pay?

Switching to Etisalat Business Quick Pay provides a wealth of advantages for businesses:

1. Time-Saving Convenience: Time is money, and Etisalat Business Quick Pay saves you plenty of both. Instead of navigating cumbersome processes or standing in queues, businesses can settle bills in minutes.

2. Simplified Financial Management: With all your payments centralized in one platform, tracking your financial obligations becomes far simpler. You can easily monitor pending bills, completed payments, and upcoming deadlines.

3. Enhanced Accuracy and Transparency: Manual payments often come with risks of errors, such as overpayments or missed deadlines. Etisalat Business Quick Pay minimizes these risks by providing a clear and transparent payment process.

4. Cost-Effective Solution: By reducing the need for manual labour, courier services, or multiple trips to payment centres, businesses can save on operational costs.

5. Eco-Friendly Approach: Going digital means less reliance on paper-based processes, making Etisalat Business Quick Pay an environmentally responsible choice.

Why UAE Businesses Prefer Etisalat Business Quick Pay?

UAE businesses prioritize efficiency, and Etisalat Business Quick Pay is built to meet these expectations. Here are some reasons why it’s the preferred choice:

1. Seamless Integration With Business Needs: The platform is designed to accommodate businesses of all sizes, from startups to large corporations. It integrates seamlessly into existing workflows, making it a valuable addition to any company.

2. Reliability and Security: Etisalat’s reputation as a trusted telecom provider ensures that businesses can rely on its payment platform without worrying about fraud or downtime.

3. Adaptability for UAE’s Growing Economy: As UAE businesses continue to evolve, Etisalat Business Quick Pay keeps pace by offering cutting-edge solutions tailored to the region’s unique demands.

4. Positive Customer Feedback: The service has garnered widespread acclaim for its user-friendly design, quick processes, and reliable results.

Conclusion

Managing business payments has never been easier. With Etisalat Business Quick Pay, you can enjoy a secure, efficient, and user-friendly experience tailored to your needs. Say goodbye to outdated processes and embrace a smarter way to handle your finances.

By leveraging this modern payment solution, businesses can save valuable time, reduce administrative burdens, and focus on achieving their strategic goals. The platform’s flexibility and 24/7 accessibility ensure you’re always in control of your payments, no matter where you are.

Don’t let payment challenges slow your business down empower your operations with the convenience and reliability of Etisalat Business Quick Pay today.

FAQs About Etisalat Business Quick Pay

What bills can I pay using Etisalat Business Quick Pay?

You can pay Etisalat-related bills, including internet services, utility charges, and other corporate accounts.

Is Etisalat Business Quick Pay secure?

Yes, it employs top-notch encryption and complies with global security standards to keep your transactions safe.

Do I need to register to use the platform?

No, registration is not required. You can directly access the portal and complete your payments.

Can I pay for multiple accounts in one go?

Absolutely! The platform supports multi-account payments, making it ideal for businesses managing multiple lines or subscriptions.

What happens if my payment fails?

If your payment fails, double-check your account details and retry. For further assistance, you can contact Etisalat’s customer support.

Are there any additional charges?

No, the platform doesn’t impose extra fees for using the service, though standard service charges may apply depending on your account.