Are you searching for the best medical insurance companies in Dubai but feeling overwhelmed by the options? With Dubai’s mandatory health insurance regulations, having the right coverage is crucial for individuals, families, and businesses.

Choosing the right provider ensures access to top hospitals, affordable premiums, and comprehensive coverage for outpatient and inpatient care, maternity, and emergency services. With so many insurers offering different policies, how do you determine which one suits your needs?

To help you make an informed decision, we have compiled a list of the top 10 medical insurance companies in Dubai based on their coverage options, customer service, and reputation.

Whether you are an expat, resident, or employer, this guide will help you find the best healthcare insurance for your needs.

What Factors Should You Consider When Choosing a Medical Insurance Company in Dubai?

Selecting a medical insurance provider in Dubai requires careful evaluation of several key factors. First, check whether the company is DHA-approved, ensuring compliance with UAE health insurance regulations.

The insurer’s network of hospitals and clinics is equally important, as a wider network means better access to healthcare services.

Additionally, look for policies that cover outpatient care, hospitalization, maternity, emergency services, and pre-existing conditions. The premium cost, deductibles, and co-payment structures should align with your budget while offering sufficient coverage.

Finally, assess the claim process and customer support efficiency, as a provider with quick claim approvals and reliable assistance ensures a hassle-free experience.

By considering these factors, you can choose a medical insurance company that offers the best protection for you and your family.

Why Is Medical Insurance Mandatory in Dubai?

Medical insurance in Dubai is legally required for all residents, including expatriates and employees. The Dubai Health Authority (DHA) mandates health insurance to ensure that everyone has access to quality medical care without financial strain.

Employers are responsible for providing health insurance to their employees, while individuals must arrange coverage for dependents.

The mandatory insurance requirement helps reduce the financial burden on the healthcare system, ensuring that everyone receives essential medical services.

Without insurance, individuals may face hefty medical bills and difficulty accessing quality healthcare. Many visa applications and renewals also require proof of health insurance.

By having a compliant insurance policy, residents and expats can benefit from comprehensive healthcare access, emergency treatment, and preventive care, ensuring long-term well-being and financial security.

Best 10 Medical Insurance Companies

1. Health Insurance Dubai

Health Insurance Dubai is a trusted medical insurance provider in the UAE, offering a wide range of health coverage plans for individuals, families, and businesses.

They specialize in providing customized insurance solutions that comply with Dubai Health Authority (DHA) regulations. Their plans cover outpatient, inpatient, maternity, and emergency services, ensuring comprehensive healthcare access.

One of their key strengths is their partnership with top hospitals and clinics across Dubai, allowing policyholders to access quality medical services with ease.

Their customer service is well-regarded for quick claim processing and 24/7 support. Whether you are an expatriate or a UAE resident, Health Insurance Dubai provides affordable and premium health coverage options to meet different needs.

- Website: health-insurance.ae

- Contact: +971 2 4911112

- Location: Indigo Icon Tower – 503-I, Level 5 – Cluster F – Dubai

2. Petra Insurance Broker L.L.C.

Petra Insurance Broker L.L.C. is a well-established insurance brokerage firm in Dubai, specializing in medical, life, and corporate insurance solutions.

With over a decade of experience, they offer customized health insurance plans that cater to individuals, families, and businesses. Petra Insurance works closely with leading UAE insurance providers to ensure competitive pricing and comprehensive medical coverage.

One of their standout features is their personalized customer service, which helps clients find the best policies suited to their needs.

Their plans cover outpatient, inpatient, maternity, dental, and emergency care. Petra Insurance is known for its efficient claims assistance and transparent policy terms, making it a preferred choice among residents and businesses in Dubai.

- Website: insurewithpetra.com

- Contact: 04 266 1800

- Location: Hotel – 1701 – Anantara Downtown Dubai – Business Bay – Dubai

3. Insurancehub.ae

Insurancehub.ae is a leading online insurance marketplace in Dubai, offering a wide range of medical insurance plans from various providers.

Their platform allows users to compare different health insurance policies and choose the best option based on their coverage needs and budget. Whether you need individual, family, or corporate health insurance, Insurancehub.ae provides tailored solutions.

One of their key advantages is their easy-to-use digital platform, where users can get instant quotes, policy comparisons, and expert consultations.

Their policies include coverage for hospitalization, outpatient visits, diagnostics, maternity, and pre-existing conditions. Additionally, their customer support team is available to guide users through the process, from selecting a policy to making a claim.

- Website: insurancehub.ae

- Contact: 04 265 5668

- Location: Al Barsha 1, Al Khaimah Building, 3rd Floor – Dubai

4. New Shield Insurance Brokers LLC

New Shield Insurance Brokers LLC is a trusted name in Dubai’s health insurance sector, offering tailored medical insurance plans to residents, expatriates, and businesses.

Their expertise lies in providing comprehensive coverage with flexible premiums, ensuring that clients get the best value for their money.

New Shield’s health insurance policies cover a wide range of medical services, including hospitalization, outpatient treatments, maternity care, and specialist consultations.

They also offer corporate health insurance packages for businesses looking to provide their employees with top-tier medical coverage. Their strong relationships with UAE’s top insurance companies allow them to secure competitive rates and extensive network coverage.

- Website: nsib.ae

- Contact: 04 705 8000

- Location: One by Omniyat – Suite 2801 – Al Mustaqbal St – Dubai

5. Gargash Insurance Services LLC

Gargash Insurance Services LLC is a DHA-approved insurance broker with a strong presence in Dubai. The company provides a range of medical insurance plans, ensuring individuals, families, and businesses receive the right level of coverage.

Their policies include comprehensive health benefits, including doctor consultations, diagnostic tests, hospital stays, and emergency care. A major advantage of choosing Gargash Insurance is their dedicated claims support team, which ensures smooth processing of medical claims.

They also offer tailored corporate health insurance solutions, making them a popular choice for businesses in the UAE. With over 25 years of experience, Gargash has built a strong reputation for reliable customer service and competitive policy options.

- Website: gargashinsurance.com

- Contact: 800 4274274

- Location: Office #305, 3rd Floor, Pyramid Centre, Opp. Al Nasr Sports Club/Tas’heel – Umm Hurair Rd – Dubai

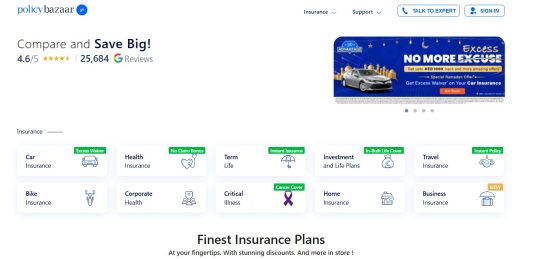

6. Policybazaar.ae

Policybazaar.ae is a leading online insurance aggregator in Dubai, offering a wide selection of medical insurance plans from multiple providers.

Their platform makes it easy for customers to compare different health insurance policies and choose the best one based on coverage, price, and benefits. Their plans cover inpatient and outpatient care, emergency treatments, maternity services, and specialist consultations.

Policybazaar.ae is well known for its transparent pricing, instant policy issuance, and efficient claims support. The platform is particularly beneficial for expats and UAE residents looking for affordable yet comprehensive medical insurance plans.

With a user-friendly interface and dedicated customer support, Policybazaar.ae simplifies the process of finding the right health insurance policy.

- Website: policybazaar.ae

- Contact: 800 800001

- Location: Al Shafar Tower 1, Office No. 1304 – Barsha Heights – Dubai

7. Omega Insurance Brokers LLC

Omega Insurance Brokers LLC is a well-established medical insurance provider in Dubai, offering tailored health insurance solutions for individuals, families, and businesses. Their expertise lies in customizing plans that provide extensive medical coverage at competitive prices.

Their policies cover outpatient care, hospitalization, dental treatments, maternity, and pre-existing conditions. Omega Insurance Brokers also specializes in corporate health insurance, ensuring businesses can provide quality healthcare benefits to their employees.

They are known for their strong customer service, seamless policy issuance, and hassle-free claim processing. With a vast network of hospitals and clinics across the UAE, policyholders can access top-tier medical care with ease.

- Website: omegainsurance.ae

- Contact: 04 302 4555

- Location: 206, Crystal Business Center, World Trade Center Road, Near ADCB Metro Station – Dubai

8. Seven Insurance Brokers

Seven Insurance Brokers is a trusted insurance brokerage firm in Dubai that offers customized medical insurance plans for individuals, families, and businesses. They work with top insurance providers in the UAE to ensure clients receive the best health coverage options at competitive rates.

Their policies include inpatient and outpatient care, emergency treatments, maternity benefits, and wellness programs. Seven Insurance Brokers is known for its efficient customer support, quick policy approvals, and personalized insurance consultations.

They also offer corporate health insurance solutions, making them a preferred choice for businesses looking to provide employee healthcare benefits. With a strong focus on customer satisfaction and transparency, Seven Insurance Brokers helps clients find the most suitable medical insurance plans in Dubai.

- Website: seveninsurancebrokers.com

- Contact: 04 436 1800

- Location: Business Central Towers, 4901 Tower B – Dubai Internet City – Dubai

9. Al Dawliyah Insurance Services H.O

Al Dawliyah Insurance Services H.O is a reputable insurance brokerage firm in Dubai, offering a range of health insurance solutions for residents and businesses.

They specialize in providing DHA-compliant medical insurance plans, ensuring policyholders receive quality healthcare coverage. Their insurance policies cover general medical treatments, maternity, hospitalization, and emergency care.

Al Dawliyah is recognized for its strong relationships with major insurance providers, allowing them to offer competitive rates and flexible plans.

Their dedicated team provides personalized assistance, helping clients choose the right coverage based on their healthcare needs and budget. Their commitment to efficient claims processing and transparent policy terms makes them a trusted choice in the UAE health insurance market.

- Website: aldawliyah.com

- Contact: 04 250 0570

- Location: Opposite EPPCO Station, Building #2, Iliyaa Building – Damascus Street – Dubai

10. Platinum Insurance Broker LLC

Platinum Insurance Broker LLC is a leading insurance brokerage firm in Dubai that offers comprehensive medical insurance plans for individuals, families, and businesses. They focus on tailoring health coverage solutions to meet different healthcare needs and budgets.

Their policies provide coverage for inpatient and outpatient treatments, specialist consultations, maternity care, and critical illness benefits. Platinum Insurance Broker LLC is known for its strong partnerships with top-tier insurance providers, ensuring clients receive reliable healthcare coverage.

Their efficient customer support team helps policyholders with claim processing, policy renewals, and medical network access. With a strong reputation for transparency and reliability, Platinum Insurance Broker LLC continues to be a trusted choice for health insurance in Dubai.

- Website: pib.ae

- Contact: 04 357 7997

- Location: 41-B Zomorodah Bldg, Landmark Huzaifa Furniture – Umm Hurair Rd – Dubai

Map:

How Can Expats in Dubai Find the Best Medical Insurance?

For expatriates living in Dubai, finding the right health insurance can be challenging due to different coverage options and pricing. Expats should start by understanding the mandatory DHA insurance requirements and checking if their employer provides adequate coverage.

If additional coverage is needed, choosing a private medical insurance plan with a strong hospital network and flexible benefits is recommended.

Expats should compare policies that cover outpatient and inpatient treatments, dental care, maternity services, and emergency hospitalization. International coverage is also important for those who travel frequently or require medical treatment outside the UAE.

Expats can use insurance comparison platforms or consult brokers to find customized health plans that fit their lifestyle and budget. Selecting a reputable and DHA-approved insurance provider ensures seamless healthcare access and financial protection.

Conclusion

Finding the right medical insurance company in Dubai is essential for securing quality healthcare at an affordable price. With Dubai’s strict health insurance regulations, having a reliable provider ensures seamless access to medical treatments, hospitalization, and emergency care.

Whether you need individual, family, or corporate health insurance, the companies listed above offer some of the best coverage options in the UAE.

Before making a decision, consider factors like policy benefits, hospital network, claim process, and customer support. Comparing different providers will help you find a plan that meets your healthcare needs and budget.

A well-chosen health insurance policy not only protects you financially but also provides peace of mind. Explore these top insurers, review their offerings, and choose the best plan for your needs today.

FAQs

What is the best medical insurance company in Dubai?

The best medical insurance company depends on your healthcare needs, budget, and required coverage. Companies like Health Insurance Dubai, Petra Insurance, and Policybazaar.ae offer comprehensive plans for individuals and businesses.

Is health insurance mandatory in Dubai?

Yes, medical insurance is legally required for all residents under DHA regulations. Employers must provide health insurance for employees, while individuals must arrange coverage for dependents.

Can expats get health insurance in Dubai?

Yes, expats can choose from various DHA-approved health insurance plans that cover outpatient and inpatient care, maternity, and emergency services. Some plans also offer international coverage.

How much does medical insurance cost in Dubai?

The cost varies based on coverage level, provider, and policy type. Basic plans start at AED 600 per year, while premium policies can exceed AED 10,000 annually.

What does Dubai health insurance typically cover?

Most policies cover doctor consultations, hospital stays, emergency treatments, maternity, diagnostics, and medications. Some plans offer dental and optical benefits as add-ons.

How do I file a health insurance claim in Dubai?

To file a claim, you must submit medical bills, receipts, and a claim form to your insurer. Some providers offer cashless claims, where bills are settled directly with hospitals.

Which medical insurance is best for families in Dubai?

Family-friendly policies from insurers like Gargash Insurance and Seven Insurance Brokers offer comprehensive coverage with affordable premiums and extensive hospital networks.